The second and third quarters of 2012 included GCP’s visits to several meetings, conferences and events, including The Incentive Marketing Association (IMA) Conference, The Motivation Show, and the Employer Healthcare & Benefits Congress. Each meting contributed to our holistic and evolved strategy for how to approach our clients’ gift card programs in order to attract and market to incentive customers. What were some key findings, insights and trends from these forums?

The IRF and the IGC commissioned Aspect Market Research Group to size the B2B gift card marketplace (U.S. incentive/loyalty). The study included 369 surveys, compiled from company executives who manage incentive and loyalty programs that include gift cards, and it sought to answer the question: “What do U.S. businesses spend on gift cards every year?” They quantified the market as $2.7 billion which does not include Scrip and Third Party. We will share the entire study with you once it becomes available. Here are are a few highlights:

The IRF and the IGC commissioned Aspect Market Research Group to size the B2B gift card marketplace (U.S. incentive/loyalty). The study included 369 surveys, compiled from company executives who manage incentive and loyalty programs that include gift cards, and it sought to answer the question: “What do U.S. businesses spend on gift cards every year?” They quantified the market as $2.7 billion which does not include Scrip and Third Party. We will share the entire study with you once it becomes available. Here are are a few highlights:

- Of that $2.7 billion, $8.5 billion is spent on sales incentive programs, $7.3 billion is spent on employe recognition programs, $5.2 billion is allocated for customer incentives, and $1.7 billion is spent on channel sales programs.

- The biggest companies, with more than $10 million in revenue, have the largest program budgets, spending 1X more on these programs, on average, than small businesses.

- The largest part, by far, of that $2.7 billion is spent by small companies with revenues of $1 million - $10 million.

- Small companies accounted for $12.9 billion in gift card spending. Medium sized businesses, $7.5 billion, and the largest firms just $2.3 billion. The key here is that small companies, what GCP cals the end customer market, is a huge opportunity. GCP continues to market and sell on our client’s behalf to the end customer market.

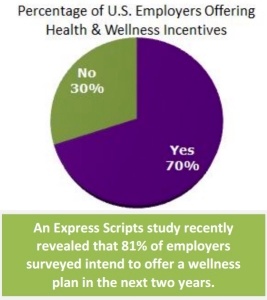

Incorporating gift cards into employe health and wellness programs remains a focal point for both third party aggregators and end-user customers. Gift cards are proven motivators and are influential in affecting behavioral changes in this market segment.

Incorporating gift cards into employe health and wellness programs remains a focal point for both third party aggregators and end-user customers. Gift cards are proven motivators and are influential in affecting behavioral changes in this market segment.

In the past 2 quarters, GCP also co-sponsored two webinars, which focused on this end customer market, specifically addressing employer healthcare and benefits issues and how gift cards are utilized within employer incentive and rewards such as health and wellness programs. We are happy to provide you with links to these resources: Healthcare Reform’s Impact on Wellness - How to Incentivize Employees to Engage in Healthy Behavior with Jonathan Edelheit from National Healthcare Reform Magazine, Vanesa Culerton from The Hillshire Brands Company, and Stacey Nelson from Health and Welfare for Sprint. Maximizing the Value & Benefits of Incentives in Corp. Welness Programs to Improve and Increase Performance with Neal S. Sofian from Premera Blue Cross and Cheryl Larson from Mediwest Business Group on Health

In the past 2 quarters, GCP also co-sponsored two webinars, which focused on this end customer market, specifically addressing employer healthcare and benefits issues and how gift cards are utilized within employer incentive and rewards such as health and wellness programs. We are happy to provide you with links to these resources: Healthcare Reform’s Impact on Wellness - How to Incentivize Employees to Engage in Healthy Behavior with Jonathan Edelheit from National Healthcare Reform Magazine, Vanesa Culerton from The Hillshire Brands Company, and Stacey Nelson from Health and Welfare for Sprint. Maximizing the Value & Benefits of Incentives in Corp. Welness Programs to Improve and Increase Performance with Neal S. Sofian from Premera Blue Cross and Cheryl Larson from Mediwest Business Group on Health

Other important findings from the last couple quarters include an increasingly high demand for multi-distribution gift card channels (plastic, digital, and mobile); this continues to be a key focus for incentive buyers. Offering multiple distribution channels greatly expands merchants’ B2B gift card opportunities in this market. These technologies offer a win-win for retailers and merchants, and for gift card users, but the hold-back for many retailers remains in the area of B2B gift cards. There are many challenges and difficulties when navigating the myriad of providers of such technologies, and GCP is now actively consulting with retailer and merchants to help navigate the path to a digital gift card future. Contact us today to inquire about these services. We look forward to your digital future! Speaking of the future, our clients are very much looking forward to the upcoming holiday season. As we enter that season, let’s look at a quick reminder of what the 201 holiday season looked like for gift cards (per the NRF):

Other important findings from the last couple quarters include an increasingly high demand for multi-distribution gift card channels (plastic, digital, and mobile); this continues to be a key focus for incentive buyers. Offering multiple distribution channels greatly expands merchants’ B2B gift card opportunities in this market. These technologies offer a win-win for retailers and merchants, and for gift card users, but the hold-back for many retailers remains in the area of B2B gift cards. There are many challenges and difficulties when navigating the myriad of providers of such technologies, and GCP is now actively consulting with retailer and merchants to help navigate the path to a digital gift card future. Contact us today to inquire about these services. We look forward to your digital future! Speaking of the future, our clients are very much looking forward to the upcoming holiday season. As we enter that season, let’s look at a quick reminder of what the 201 holiday season looked like for gift cards (per the NRF):

Gift Cards were the most requested gift for 201 and it’s expected to continue through the 2012 holidays!*

Gift Cards were the most requested gift for 201 and it’s expected to continue through the 2012 holidays!*

*Sources: $28 bilion stat: NRF & $43 bilion stat: Mercator Nov 2012 forecast

*Sources: $28 bilion stat: NRF & $43 bilion stat: Mercator Nov 2012 forecast